when is capital gains tax increasing

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it.

Managing Tax Rate Uncertainty Russell Investments

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

. 13350 of the qualified dividends and long-term capital gains 83350 70000 is taxed at 0. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. It also includes income thresholds for Bidens top rate proposal and the 38.

Assume the Federal capital gains tax rate in 2026 becomes 28. If you sell stocks mutual funds or other capital assets that you held for at. The table below breaks down long-term capital gains tax rates and income brackets for tax year 2022.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. With average state taxes and a 38 federal surtax. In 1978 Congress eliminated.

House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Long-Term Capital Gains Taxes.

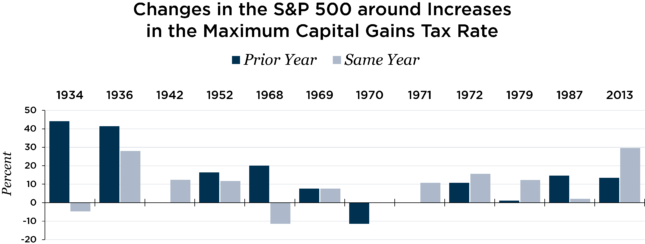

A Retroactive Capital Gains Tax Increase. Capital gains tax rates were significantly increased in the 1969 and 1976 Tax Reform Acts. Since the 2021 tax brackets have changed compared with 2020 its possible the rate youll pay on short-term gains also changed.

Just like income tax youll pay a tiered tax rate on your capital gains. The capital gains tax is based on that profit. From 1954 to 1967 the maximum capital gains tax rate was 25.

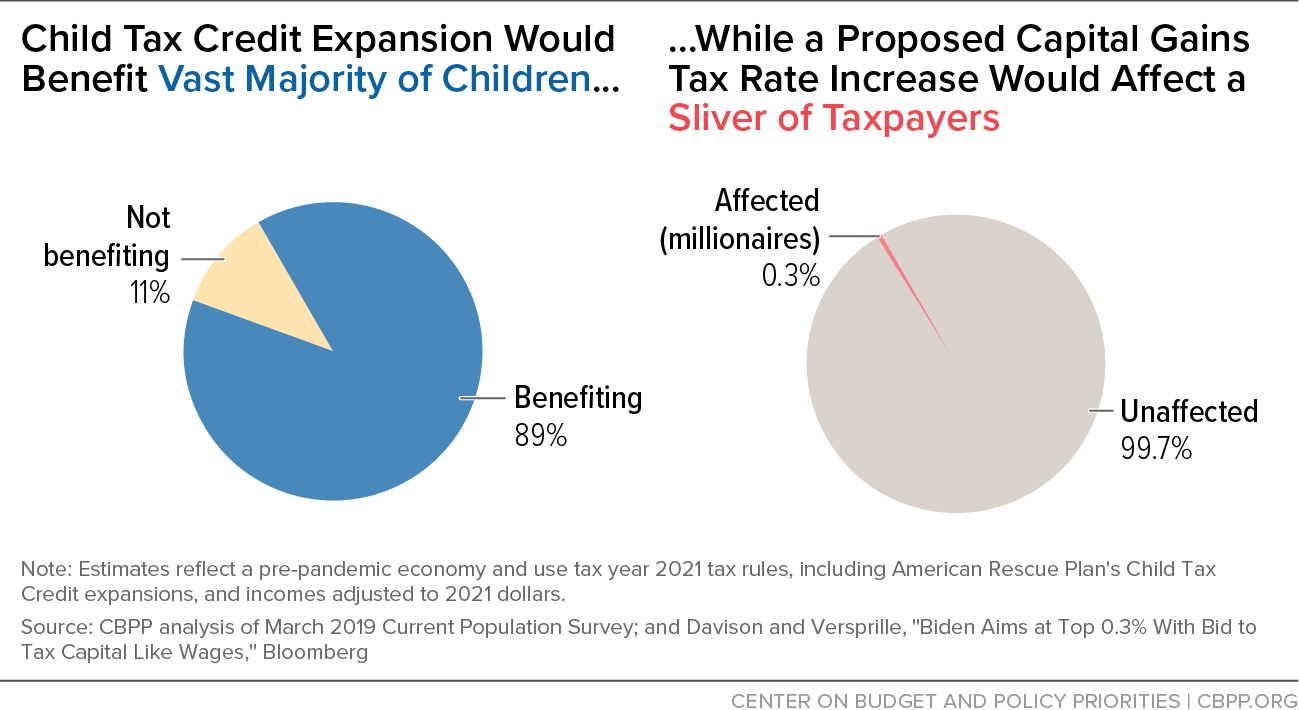

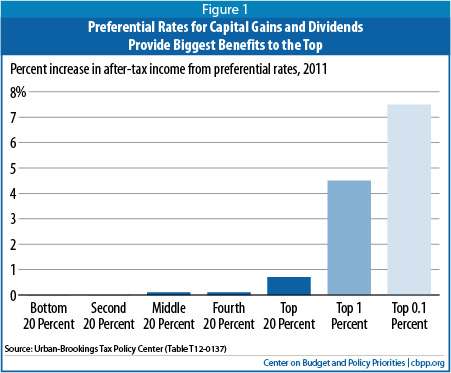

The top 01 a group of just 120000 people earning an average of more than 11 million a year earned more than half of all capital gains income in the United States in 2019. This is called a realized gain. President Joe Bidens American Families Plan will likely include a large increase in the top federal tax rate on long-term capital gains and qualified dividends from.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Capital Gains Tax. The expectation of this increase resulted in a 40 increase in.

Unlike the long-term capital gains tax rate there is no 0 percent. The maximum zero rate amount cutoff is 83350. The proposed increase would tax long-term gains over 1 million as ordinary income which means that these high-income investors would have to pay a top rate of 396.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Your 2021 Tax Bracket To See Whats Been Adjusted. A Retroactive Capital Gains Tax Increase.

In some cases you add. Its time to increase taxes on capital gains. A capital gain is profit made on the sale of an asset like a home or investment property that has increased in value during the holding period.

2022 federal capital gains tax rates. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Which capital gains tax rate applies to 2023 long-term gains will depend on your taxable income.

For example a single person with a total short-term capital gain of. Currently the highest rate for long-term capital gains is 238 percent compared to a top rate of 408 percent on short-term capital gains 37 percent top marginal income tax rate.

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Do Capital Gains Tax Increases Reduce Revenue Committee For Economic Development Of The Conference Board

Child Tax Credit Expansion Would Benefit Vast Majority Of Children While A Proposed Capital Gains Tax Rate Increase Would Affect A Sliver Of Taxpayers Center On Budget And Policy Priorities

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

Sweeping Reform Would Tax Capital Gains Like Ordinary Income Itep

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

Accelerating 2021 Business Sales To Avoid Biden Tax Increase

Capital Gains And Tax Reform Committee For A Responsible Federal Budget

Raising Today S Low Capital Gains Tax Rates Could Promote Economic Efficiency And Fairness While Helping Reduce Deficits Center On Budget And Policy Priorities

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

A Probable Capital Gains Tax Rate Increase And The Potential In Opportunity Zones Caliber

How Biden An Increasing Capital Gains Tax Affects Oz Investing

Effects Of Changing Tax Policy On Commercial Real Estate

Stocks Retreat On Capital Gains Plan Nationwide Financial

S P Stock Market Performance And Capital Gains Tax Increases Human Investing

Capital Gains Tax Hike Would Imperil Active Mutual Funds Bloomberg